Published November 29, 2022

Caveat Emptor: The Fees & Structure of Masterworks Offerings

Masterworks is an alternative investment platform that offers fractional ownership of blue-chip artwork. The general appeal of Masterworks lies in its ability to offer everyday investors access to the art market for artists like Helen Frankenthaler, Jean-Michel Basquiat, and Mark Rothko, which would otherwise be out of reach as works by these artists sell for millions of dollars.

Launched in 2017, the company proposes that investors add artwork to their overall portfolio strategy given the benefits of diversification, low correlation, and outperformance of the Post-War & Contemporary Art relative to the equity market. Masterworks notes that this “category showed price appreciation at an estimated annualized rate of 13.8% from the year ended December 31, 1995 to December 31, 2021, versus 10.2% for the S&P 500 Index.” (i) For each painting acquired by Masterworks, the company creates a Delaware LLC and publicly offers equity interests in that painting through a SEC qualified offering.

As a former corporate credit analyst, I find myself at home on the SEC website reading through filings. After hearing more than a few advertisements for Masterworks, I decided to conduct my own review of the most recently published offering circulars, which is a filing that describes a financial security for potential buyers.

Given frequent questions on Masterworks and the overall fractionalization of artwork, I reviewed several of the most recent offering circulars, summarized the findings of my review, and highlighted the respective rights of and payments to Masterworks and the shareholders of the various Delaware LLCs Masterworks creates to facilitate investment in art:

- Shareholders have no say in the price, timing, or method of the sale of the artwork. Voting rights for shareholders are limited.

- Upon completion of the offering, Masterworks immediately pays itself 10-11% of the offering proceeds as a form of “true-up” despite modest contributed capital. Therefore, shareholders immediately recognize a 10-11% investment decline.

- If Masterworks sells a work without a third-party intermediary (auction house, gallery, etc.), it can charge a fee to the new buyer that could range between 14.5-25%, which shareholders are unlikely to access.

- Masterworks issues annual preferred shares with a liquidation preference of $20 per share to itself as a management fee. These preferred shares dilute common shareholders by 1.5% per year, and the nature of the shares allows full payment even if the work is sold at a loss.

- The offering circular lists the potential conflicts of interest including the above mentioned management fee and right to collect a fee in the event of a sale without the use of a third-party intermediary. Masterworks notes that it “cannot assure investors that we will execute a discretionary sale of the Artwork at a time that is in the best interests of holders of the Class A shares.” (ii)

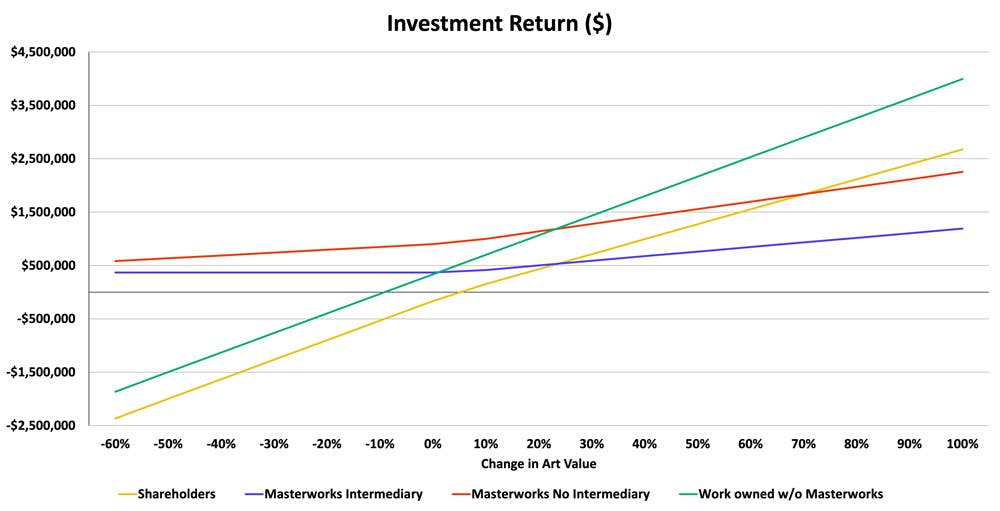

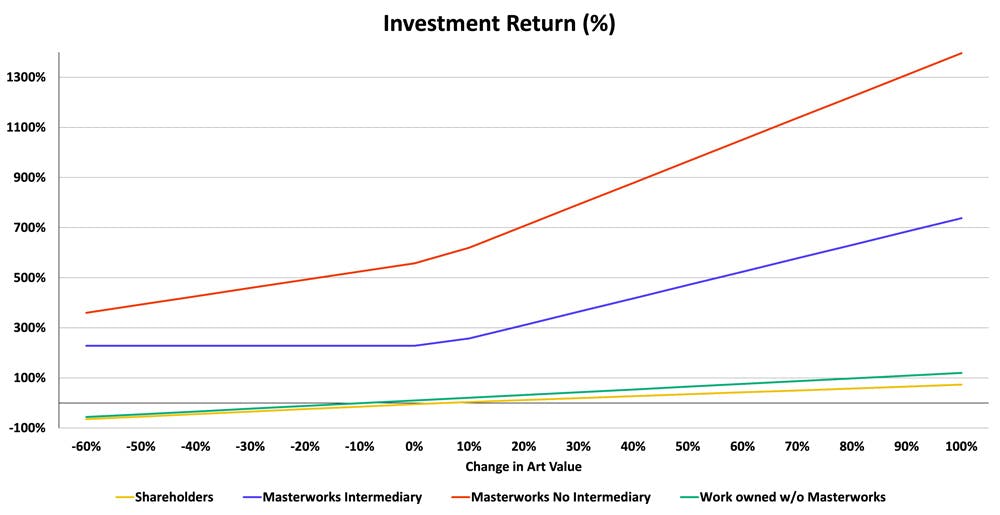

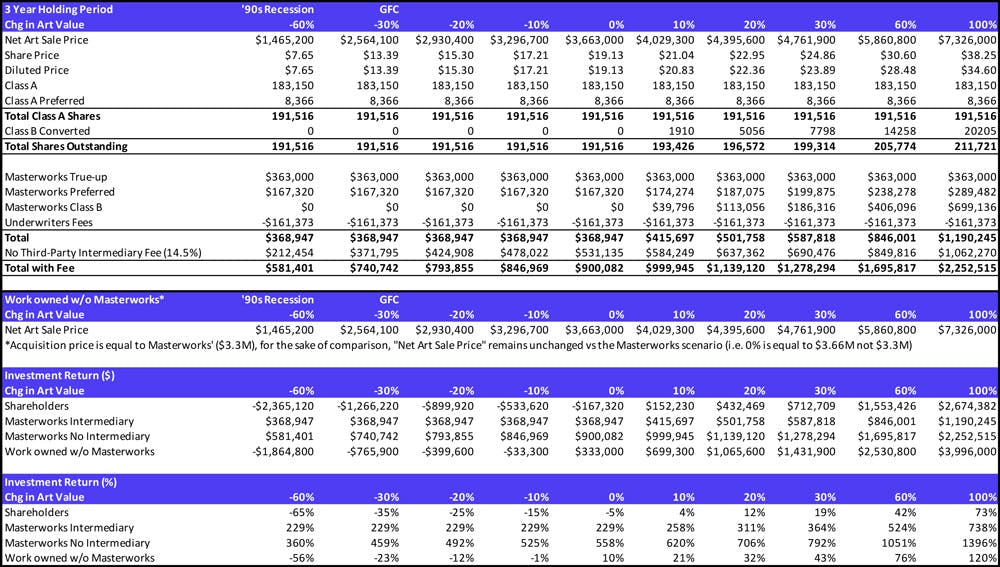

- The existing fee structure could allow Masterworks to generate a positive return regardless of whether an artwork is sold significantly below the acquisition price. Assuming a three-year holding period, in a scenario where the artwork is sold down 60% (like the decline in contemporary art values during the recession in the early 1990s), Masterworks still generates a +229% return if it uses an intermediary and a +360% return if it does not. This compares to shareholders, whose investment is down 65%. On the other hand, at a 100% increase in art value, Masterworks earns a+1396% return (when not engaging an intermediary) versus shareholders who earn a +73% return.

At my core, I wholeheartedly believe that collecting art has a transformative impact on our ability to think, see, and feel. When acquiring work directly from artists, you make an investment not only in your own collection but also in the career and practice of the artist. Similarly, acquiring works from a gallery representing the artist, benefits not only the artist but also the organization that shepherds their respective career.

This is not the case with an investment in a Masterworks offering. Yes, from an overall portfolio strategy standpoint, investment in art increases diversification, but art is not a commodity. The intrinsic value is built over decades through the hard work of artists, curators, galleries, and institutions. The Masterworks model most benefits Masterworks, while doing little to benefit the artists or the ecosystem that ultimately drives value and cultural impact.

Acquisition Process and Structure of the Transaction

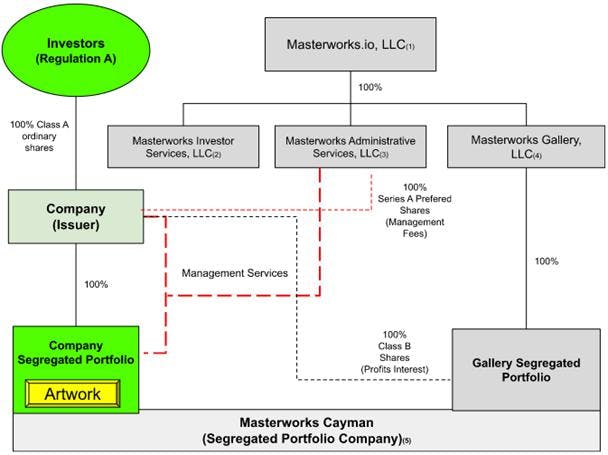

Masterworks owns 100% of 3 separate entities: Masterworks Investor Services, Masterworks Administrative Services, and Masterworks Gallery. (iii) Since September 2019, Masterworks completed 142 Regulation A offerings across 38 artists. (iv)

According to the Masterworks site, less than 2.4% of artworks that the company reviews passed the diligence process. (v) After the identification process, Masterworks Gallery will acquire the painting in the secondary market either from an auction house, gallery, or private collector.

The timing of the close of the purchase is scheduled to occur “on or before the initial closing” of the offering. (vi) Formally, following the initial close of the offering, the title to the artwork will be held in a segregated portfolio of Masterworks Cayman, which is a Cayman Islands based portfolio company.

Upon completion of the offering, investors will own 100% of the Class A ordinary shares, Masterworks Gallery will own 100% of the Class B shares, which represent a 20% profits interest, and Masterworks Administrative Services will be granted Class A Preferred shares as compensation for their fees. (vii)

Who Can Participate

The minimum investment amount per shareholder in a single offering is $15,000, and the maximum amount is $100,000 per shareholder. Masterworks reserves the right to waive the minimum and maximum purchase requirements. However, as a Tier 2 Regulation A offering, investors cannot pay more than 10% of their annual income or net worth unless the individual is an “accredited investor.” (viii)

Analysis of Fees

Masterworks charges various fees and expenses to shareholders in the form of cash expenses paid from shareholders' investments and non-cash expenses paid through preferred shares.

Upon the completion of the offering, Masterworks will immediately expense shareholders with 10-11% of the total proceeds of the offering as an upfront cash payment. This “true-up” is intended to compensate Masterworks for “performing sourcing services, including identification of the seller research, analysis, evaluation, inspection, appraisal, due diligence and transaction negotiation and execution services to acquire the Artwork; commitments of capital to finance the acquisition of the Artwork, and administrative services and costs.” (ix)

Throughout the holding period of the artwork, which Masterworks calls out as 3-10 years, the company will charge management fees of 1.5% per year in the form of Class A preferred shares. This class indicates that upon the sale of the artwork, regardless of whether it was sold profitably, Masterworks will be paid ahead of ordinary shareholders at a $20.00 per share liquidation preference. (x) Given the stated holding period, in management fees alone, shareholders will be diluted by 4.4% in 3 years and 13.8% in 10 years.

As part of the offering, Masterworks will also issue itself 1,000 Class B shares, which represent a 20% profits interest realized from the sale of the artwork. Immediately before the sale is complete, the Class B shares will convert into Class A, further diluting shareholders. (xi)

Masterworks is entitled to additional fees when Masterworks determines to sell the artwork without a “third-party intermediary.” In that event, Masterworks would “charge the buyer of the Artwork a reasonable fee not to exceed the lowest published buyer’s premium charged by Sotheby’s, Christie’s or Phillips in effect at such time.” (xii) At the time of the article, Sotheby’s and Christie’s charge between 14.9%-26% and 14.5-25% respectively in terms of buyer’s premium dependent upon the total hammer price. (xiii) In the Management Services Agreement, Masterworks Administrative Services lists this fee as part of compensation along with the issuance of the Class A preferred shares. (xiv)

Lastly, any “extraordinary costs or non-routine services” will be reimbursed to Masterworks upon the sale of the artwork. This includes: “Payments associated with litigation, judicial proceedings or arbitration (regardless of whether or not the Company is a named defendant or party to such litigation), including, without limitation, attorneys’ fees, settlements or judgments.” (xv)

Rights as Shareholder

Masterworks, in its “sole and absolute discretion, will have the ability to sell the Artwork at any time and in any manner.” (xvi) The price, timing, and method of sale do not require shareholder approval. The Class A shares have "no voting rights other than to vote, as a single class, to remove and replace the Administrator and to remove a member of the Board of Managers for “cause” only." The vote requires an affirmative vote of 2/3 of the issued and outstanding voting shares. (xvii)

Potential Conflicts of Interest and Masterworks' Mitigation Efforts

The offering circular lists the potential conflicts of interest that could arise between the company and Masterworks. The previously discussed management fees in the form of preferred shares and the potential to collect a fee without the use of a third-party intermediary were included. Masterworks also notes the potential to register as a broker-dealer to earn transaction fees from the trading of Class A shares. The company views this as a potential conflict of interest because if the activity is profitable, it “will be incentivized not to sell the Artwork and liquidate us, even in situations in which a sale of the Artwork is in the best interest of holders of the Class A shares.” (xviii)

Also included are provisions in the operating agreement and management services agreement with the Administrator that “limit remedies available” for investors for “actions that might otherwise constitute a breach of duty.” The section concludes with Masterworks noting that it “cannot assure investors that we will execute a discretionary sale of the Artwork at a time that is in the best interests of holders of the Class A shares.” (xix)

Recall that in exchange for the management services, the Administrator receives annual management fees in the form of 1.5% outstanding preferred shares. Those shares are subject to cliff vesting on December 31, 2025. The vesting will be accelerated provided that an “Approved Sale is consummated.” Such a sale requires approval from a “Special Committee” that is comprised of two independent directors. As part of the definition of an “Approved Sale,” the “Special Committee” must “determine that such sale is in the best interests of the shareholders unaffiliated with the Administrator.” If the Special Committee does not approve the sale, then the unvested Class A preferred shares are forfeited. (xx)

Historical Performance (Work of Keith Haring and Masterworks Overall)

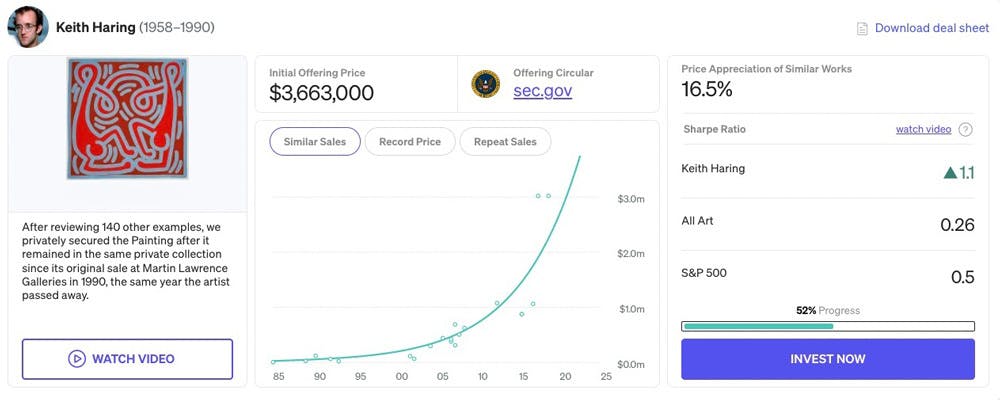

On November 18, 2022, Masterworks 156, LLC, filed an offering circular for Keith Haring’s painting, Untitled No. 10. The company is offering $3.663 million of Class A shares to fund the acquisition of the painting which it agreed to acquire for $3.3 million on September 23, 2022 in a “privately negotiated transaction from an auction house.” (xxi)

As part of the filing, Masterworks compiled a list of historical data for 20 auction sales for similarly scaled works by Haring between 1985 and 2018 and noted that between that period the realized prices increased at an estimated 16.5% CAGR (Compound Annual Growth Rate). Important to note that the footnotes highlight that “historical appreciation rates are not comparable to, or intended to represent or be a proxy, for returns on Masterworks Shares.” (xxii) Additionally, this CAGR extends over 30 years, with most of the appreciation of the work occurring within the first 20 years. Masterworks specifically calls out a “work on metal comparable in scale” sold in June 2017 for $3.035 million. (xxiii) Given that Untitled No. 10 was acquired for $3.3 million in 2022 and that those two works were likely of comparable value in 2017, a 1.69% CAGR over the last 5 years is implied, which is materially lower.

The offering also provides a “Sharpe Ratio” for the work of 1.1. (xxiv) The Sharpe Ratio is used by the finance industry to understand and compare risk adjusted returns. A higher ratio is perceived as better with Masterworks comparing the artist’s Sharpe Ratio to 0.5 for S&P 500. The filing does not provide the data set used to compute the Sharpe ratio but noted it reflects “the average annualized artist market appreciation (depreciation) of artworks by an artist that have sold at least twice at public auction.”

As a platform, Masterworks touts a Net Realized Annualized Track Record of 26.8%. This is based on the sale of 8 artworks between November 2020 and October 2022. (xxv) Important to note, that this represents only 5.62% of the 142 completed offerings and that all the sales took place within 3 years (7 out of 8 within 2 years), which is inside of the espoused 3-10 year holding period.

Scenario Analysis of Returns for Masterworks 156, LLC

Again, using the offering circular for Keith Haring’s work, Untitled No. 10, as an example, we can assess the potential returns for shareholders and Masterworks under various scenarios. As Masterworks has called out a 3-10 year holding period, this scenario analysis assumes that the artwork was held for 3 years.

The offering circular also notes that the Post-War and Contemporary art category showed annualized price appreciation of 13.8% between 1996 and 2022. (xxvi) Because the time period used in the circular leaves out the early 1990s recession when the contemporary art market suffered year- over -year declines of 56.8%, which outpaces the 28.5% decline in the contemporary art market during the Great Financial Crisis. (xxvii) Therefore, scenarios will range from -60% to +200% (+200% was used as the highest hypothetical value in Masterwork’s Class B dilution table).

For this exercise, the invested capital by Masterworks is considered the underwriting fees, which for this offering were $161,373. (xxviii) As the acquisition of the painting “is planned to occur on or before the initial closing of this Offering,” carrying cost should be immaterial. The invoice for the purchase of the painting, notes that the acquisition was agreed to on September 23, 2022 but the due date for payment was not until December 22, 2022. (xxix) The circular does make mention of the potential for an advance payment “if and to the extent such proceeds [of the offering] are less than the purchase price,” but this advance does not incur interest. (xxx) Therefore, the underwriting fees will be considered the sole cash outlay by Masterworks for the purposes of this analysis.

Returns for Masterworks differ significantly if the company decides to sell the artwork without engaging a third-party intermediary. Again, the language in the circular suggests that such a fee could be 14.5-25%, and so a 14.5% fee was chosen for this analysis. In the spirit of transparency, the supporting work for this analysis is available here.

The analysis shows the asymmetric return profile for Masterworks versus the shareholders. This is particularly true when the artwork declines in value, where Masterworks has at least a 229% return on its investment if it uses an intermediary for the sale. If the artwork value remains unchanged or declines, shareholders will underperform that change given the presence of fees. When the artwork increases in value, the shareholder return significantly lags the returns of Masterworks. At a 100% increase in art value, Masterworks earns ~19x (when not engaging an intermediary) versus shareholders on a returns basis.

In dollar amount, the artwork needs to increase in value by ~25% in the three-year holding period used for shareholders to return equally with Masterworks when it uses an intermediary. If Masterworks does not choose to use an intermediary, then the artwork needs to increase in value by ~80% in three years for dollar returns to be equal.

Masterworks Secondary Market

Shares of Masterworks offerings are not listed on a national securities exchange. In November 2022, Masterworks migrated to a new trading platform operated by Templum Markets, which along with its administrator, DriveWealth, are registered broker-dealers. (xxxi) The platform only allows limit orders that require a price and quantity when placing a buy or sell order, these orders will then be matched by an algorithm when the limit orders are within range. There are not currently any transaction fees, but “Masterworks reserves the right to impose fees or costs in the future.” (xxxii)

Such a matching system relies on investor interest to develop and maintain an active liquid market. Masterworks warns in the filing that “investors should be prepared to hold their Class A shares for an indefinite period of time, as there can be no assurance that the Class A shares will ever be saleable through the Templum ATS or an alternative platform.” (xxxiii) Given this warning, it is important to note the relatively small market capitalization.

Masterworks also articulated that “Any posted offer prices or historical transaction information reflected on the Templum ATS should not be construed as being representative of the fair value of the Company’s Class A shares or of the Artwork." (xxxiv) Therefore, the use of the secondary market for price discovery is equally limited.

Furthermore, recall that shareholders have no control over the price, timing, or method of the artwork sale. Even if one were to purchase 100% of the shares outstanding for a given artwork in the secondary market, Masterworks still has sole discretion on the sale.

The purpose of the above analysis is not to assess the investment quality or potential returns for an artwork by Keith Haring. The purpose of the analysis is to shed light on the business model and fees of Masterworks. The thoroughness of this analysis is indicative of the rigor at Testudo in our curation of the artists and our commitment to practical education.

As outlined above, the The Masterworks model most benefits Masterworks, while doing little to benefit the artists or the ecosystem that ultimately drives value and cultural impact.

This model treats artwork solely as an investable asset and ignores that these artworks were created by talented artists who imbued these pieces with meaning. Masterworks arrives at the very end of the journey by acquiring artwork on the secondary market from auction houses and dealers. They do not discover new talent or shepherd the careers of artists. The value that Masterworks is selling was built over decades by the artists themselves, curators, galleries, institutions, and the collectors who believed in them.

The mission to create more access to the art world is compelling, but the model of Masterworks does little to benefit the ecosystem in which the company reaps rewards. Investors in Masterworks’ fractional ownership also miss out on one of the best elements of collecting: living with the art. When you purchase an artwork from an artist, gallery, or online platform, you not only support the artist but also the organizations that promote them.

We started Testudo because we believe more people can benefit from collecting art. We believe our model offers customers the ability to collect art and diversify while also enjoying and living with the art itself. The ultimate value of art extends so much further than its price alone. Learn more about Testudo here.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our site constitutes a solicitation, recommendation, endorsement, or offer by Testudo to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the Site constitutes professional and/or financial advice, nor does any information on the Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the Site before making any decisions based on such information or other Content. In exchange for using the Site, you agree not to hold Testudo liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the Site.

END NOTES

(i) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 5. EDGAR. United States Securities and Exchange Commission. Link

(ii) Ibid, 48.

(iii) Ibid, 6.

(iv) Ibid, 39.

(v) “Current Offerings” Masterworks, Link

(vi) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 4. EDGAR. United States Securities and Exchange Commission. Link

(vii) Ibid, 6.

(viii) Ibid, 7.

(ix) Ibid, 52.

(x) Ibid, 56.

(xi) Ibid, 26-27.

(xii) Ibid, 5.

(xiii) Ibid, 42.

(xiv) MASTERWORKS 156, LLC. (2022, October 06). Form 1-A, Exhibit 6-1 [FORM OF MANAGEMENT SERVICES AGREEMENT]. Pg. 4. EDGAR. United States Securities and Exchange Commission. Link

(xv) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 48. EDGAR. United States Securities and Exchange Commission. Link

(xvi) Ibid, 48-49.

(xvii) Ibid, 58.

(xviii) Ibid, 48.

(xix) Ibid, 48.

(xx) MASTERWORKS 156, LLC. (2022, October 06). Form 1-A, Exhibit 6-1 [FORM OF MANAGEMENT SERVICES AGREEMENT]. Pg. 21. EDGAR. United States Securities and Exchange Commission. Link

(xxi) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 4. EDGAR. United States Securities and Exchange Commission. Link

(xxii) Ibid, 46.

(xxiii) Ibid, 45.

(xxiv) Ibid, 46.

(xxv) Ibid, 39.

(xxvi) Ibid, 5.

(xxvii) Citigroup. (2020, December). Citi GPS: The Global Art Market and COVID-19. Pg. 11. Private Bank. Citibank. Link

(xxviii) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Cover page. EDGAR. United States Securities and Exchange Commission. Link

(xxix) MASTERWORKS 156, LLC. (2022, October 06). Form 1-A, Exhibit 6-3 [FORM OF MANAGEMENT SERVICES AGREEMENT]. Pg. 21. EDGAR. United States Securities and Exchange Commission. Link

(xxx) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 5. EDGAR. United States Securities and Exchange Commission. Link

(xxxi) Ibid, 59.

(xxxii) “Masterworks Secondary Market FAQ.” Masterworks, Link

(xxxiii) MASTERWORKS 156, LLC. (2022, November 18). Offering Circular Form 253(g)(2). Pg. 21. EDGAR. United States Securities and Exchange Commission. Link

(xxxiv) Ibid, 60.