Published July 29, 2022

Why We Support Artist Resale Royalties

While most are familiar with music royalties and television residuals, there is a degree of controversy surrounding resale royalties for artists within the art world. At Testudo, we strongly support resale royalties. They're essential to the equity and health of the art market and its participants, and that's why we've built them into our business model.

First let’s define the key terms. A sale happens when a work is purchased for the first time directly from an artist or gallery. In this sale, the artist receives a predetermined share of the proceeds. If that same artwork is then purchased by another collector at a later date, this is considered a resale. A resale royalty is calculated as a percentage of either the gross resale or profit and paid to the original artist. Typically in the US the original artist receives no portion of the proceeds from resale.

Considering the value of an artwork will often rise as an artist develops their career, resale royalties are designed to ensure that artists can participate and benefit in the economic appreciation of their work.

Brief History

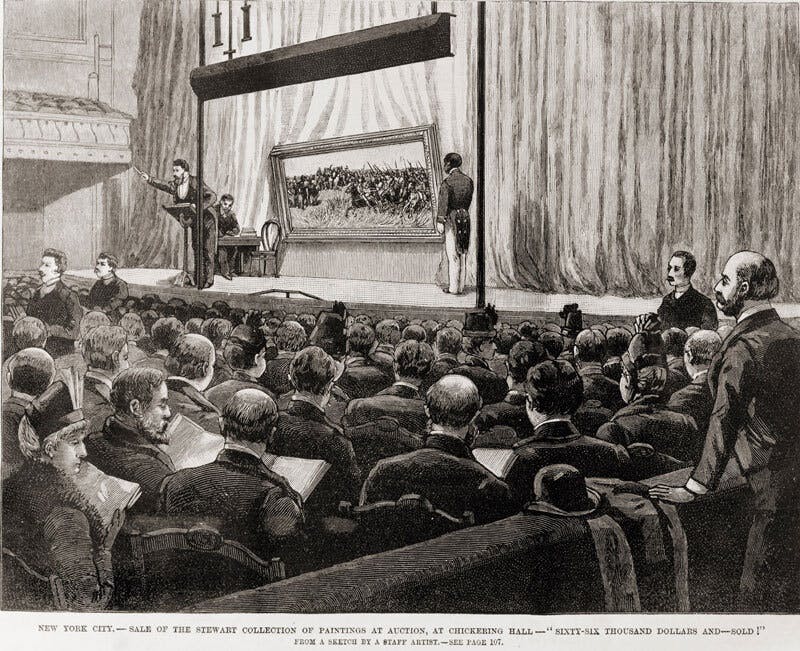

During the early twentieth century in France, there was growing activism pursuing droit de suite (literally translated to “right to follow”). In an effort to sway public sentiment, the French impressionist painter, Jean-Louis Forain, illustrated a cartoon (shown below) depicting an impoverished artist and his child looking on as one of his paintings sold at auction to aristocrats. This contributed to the passage of the first law supporting resale royalties for artists in 1920.

Today, droit de suite continues in the EU, UK, and Australia. DACS, which is the non-profit responsible for collecting and distributing royalties to visual artists in the UK, paid out £94 million in resale royalties between 2006 and 2021.

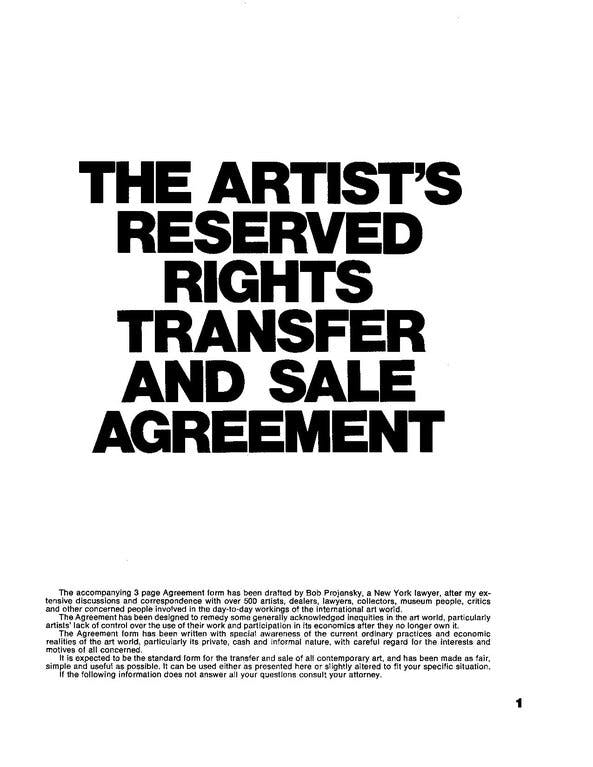

The United States has not seen the same level of adoption or support for resale royalties. In 1971, Seth Siegelaub, a dealer of conceptual art, and Bob Projansky, an attorney, published “The Artist's Reserved Rights Transfer and Sale Agreement," which is more commonly known as the Projansky contract. According to Sigelaub, the agreement “has been designed to remedy some generally known inequities in the art world, particularly artists’ lack of control over use of their work and participation in its economics after they no longer own it.”

A provision was included in the agreement that upon resale, the seller pays the artist 15% of the gross profit (resale price less original purchase price). Despite translation into four languages, the Projansky contract saw limited use with the exception of Hans Haacke, who used a version of the contract throughout his career.

The secondary market for contemporary art achieved heightened public awareness with the 1973 auction of Robert and Ethel Scull’s collection of 50 works of abstract expressionism and pop art. The landmark sale of the collection totaled $2.2 million. Famously, Robert Rauschenberg confronted Scull at the auction after his work, Thaw, for which Scull originally paid $900, sold for $85,000 at auction. Rauschenberg scolded Scull and stated, “I’ve been working my ass off for you to make that profit.” Subsequently, the art critic and historian, Robert Hughes, wrote an essay the following year in Time magazine, where he made the case for artist royalties and highlighted the interaction between Rauschenberg and Scull.

In 1977, California passed a law granting a 5% royalty on any work resold in California or by a California resident outside the state. However, this law was ruled unconstitutional in 2012 by the US District Court, Central California, and in 2018, the US Court of Appeals ruled that the resale royalty only applies to works resold between 1977 and 1978.

For over one hundred years, there has been active discourse surrounding resale royalties but no clear path towards equitable distribution here in the US. With the recent defeat of the law in California, there is unlikely to be renewed interest from lawmakers to legislate resale royalty rights for artists in the near term.

As a result, private contracts within the United States are likely the best way to create a royalty right, but the key challenge for resale royalties is enforcement. Without government regulation, who is responsible for ensuring payment? In the Projansky contract, the agreement is enforceable between the artist and initial buyer, but the agreement is much more difficult to enforce upon subsequent new buyers of the work.

While the rise of NFTs and smart contracts have recently sparked renewed interest in the topic, many artists may not choose to work with a digital medium.

In September 2020, Christopher Bradley, an Assistant Professor of Law at the University of Kentucky, proposed the creation of “Art LLCs” where the sale of art would be structured as the sale of a membership interest in a business entity that holds title to the work. Bradley posits that this structure could serve as a workaround for many of the enforcement challenges presented by the Projansky contract. For established artists, the administrative costs associated with the creation of LLCs could be worthwhile but is likely onerous for emerging artists.

Our View

At Testudo, we believe resale royalties are paramount to the long term health of artists and that collectors are best served when they act as stewards and partners.

We believe that our platform offers a model of enforcement through our closed ecosystem. Within our strategy, artwork only enters Testudo directly from the artist. While we hope that artwork stays with its collector forever, we understand that this isn’t always possible. To prevent market speculation, collectors are only able to resell works one year after purchasing. When a work does resell on the platform, we include 5% royalty as part of the transaction. As those transactions occur on our platform, we’re able to enforce that the royalty is collected and paid. Therefore, we ensure that our artists benefit from the continued appreciation of their work.